Email marketers of financial services and products (FS) have it much, much harder when it comes to achieving great deliverability.

In Validity’s newly released Email Deliverability Benchmark report, the FS sector scores the lowest of 15 major verticals, with only 80 percent inbox placement rates (IPRs). This means 1 in every 5 legitimate, permission-based FS marketing emails aren’t delivered to recipients’ inboxes! Instead, these emails either end up in spam (8.4 percent) or get categorized as missing (11.6 percent), which means they were blocked/rejected. This failure rate is one-third higher than our global benchmark.

But why is this the case? Let’s dive into the reasons behind the FS email deliverability challenge.

Breaking down the financial services deliverability dilemma

Let’s face it: FS isn’t the most engaging topic. Not many people wake up saying, “I’m going to open a new bank account today!”

The long periods between transaction cycles make it harder to maintain subscriber interest. Plus, fear of fraud means consumers are less likely to trust emails containing finance-related content.

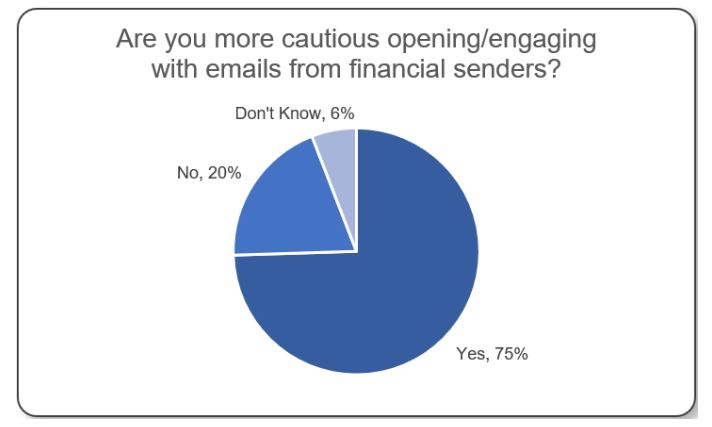

But don’t just take my word for it. On Validity’s FS edition of the State of Email Live webinar series, I asked our audience for their views on the matter: a resounding 75 percent said they’re more cautious when opening and/or engaging with emails coming from financial senders!

Their responses clearly show the challenge FS senders face, especially when it’s not just marketing messages they have to worry about. Monthly statements and T&C updates (which are contractually required) mean 100 percent IPRs aren’t simply nice to have; they are essential!

Top sending tips all senders can benefit from

But it’s not all bad news. While the best FS email programs need to work harder to maintain strong email performance, they also reap massive rewards for their efforts.

We spoke with three FS senders and Validity partners who enjoy a 99 percent average inbox placement rate between them, and they shared their top tips and tactics senders from all sectors can benefit from.

1. Build real relationships

For FS senders, building strong relationships that last across the entire customer journey is critical. It’s tough standing out in a highly competitive market, which is why authentic personalization is such a vital part of building an effective FS communication strategy.

On State of Email, Jaycee Brown from Snap Financial highlighted the importance of taking time to build a deep understanding of her customers. When developing her campaigns, she places a strong focus on what her customers really want so she can create personalized, relevant content that converts—all while building strong, long-lasting relationships.

Rodrigo Gomes from Brazilian investment bank BTG Pactual made an eloquent point: it’s not only his clients’ money he’s working with, but also their lifelong dreams. Therefore, coming from a place of understanding, empathy, and compassion is essential. Subscribers will see right through (and may even be turned off by) cookie-cutter content.

2. Collaborate with stakeholders

For many FS customers, their primary relationship is with their financial advisor, so effective personalization means senders must collaborate with these teams.

Janel de la Luz explained how Northwestern Mutual’s email team works closely with their advisors to create fresh email designs, craft relevant content, and ensure each message complements the relationships they’ve worked so hard to build.

BTG Pactual uses different sending personas (generic and individual) with their relationship emails. They use the advisors’ real names to add credibility to their messages and make them highly relevant to each recipient.

3. Embrace privacy as an opportunity

While new privacy laws present new challenges for email senders, they also create opportunities for relationship building.

At Northwestern, Janel said privacy changes have helped her to keep her relationships with clients’ inboxes top of mind. Jaycee agreed, saying the direction generated by new laws encourages Snap Financial to focus on talking to customers at the right time about the right things (and not invading their space).

Rodrigo discussed a safety dividend, welcoming new privacy policies that provide greater security for BTG Pactual and their customers.

4. Ensure creative is crystal clear

The first principle of mailbox provider guidance to email marketers is “Don’t look like a spammer!” This advice is doubly important for financial services, where the risk is not just looking spammy—but also potentially looking fraudulent.

Our FS senders talked about the importance of developing triggered programs driven by behavioral data to drive higher engagement, as well as using creative designed with mobile-centricity and accessibility in mind.

Jaycee described how Snap Financial previews all new emails using Everest’s design & content functionality. Rodrigo highlighted the importance of understanding subscriber context at the point they engage with their emails, and how subject line optimization helps with this. Janel highlighted the importance of continuous testing to learn what works best for her audience.

5. Double down on deliverability

All our FS senders are highly focused on deliverability. The all-important focus on relationship building means they fully understand the critical dependency on getting these messages delivered in the first place.

Standard processes include verifying all new addresses, maintaining consistent daily volume, and throttling higher volume sends. Rodrigo checks three BTG Pactual KPIs every single day in Everest: reputation score, inbox placement, and suspicious activity.

To fully optimize these metrics, he also follows a “deliverability manifesto,” which includes:

- Explicit opt-in

- Regular list validation

- Full authentication (SPF, DKIM, DMARC)

- Using a dedicated and Certified IP address(es)

- Only sending emails to people who want them

- Offsetting sending schedules (away from top of hour)

- Using send time optimization

- Removing all bounces immediately

- Making it easy to unsubscribe

Our FS senders use Validity solutions to solve business-critical challenges like deliverability at Gmail, rendering in Outlook, privacy restrictions from Apple iOS, and mobile engagement (where accessibility is so important).

Rigorous data quality, relentless testing, confidence from Certification, and reporting that identifies issues before they become problems—these are the keys that unlock strong email performance and build relationships that sell more financial products and services.

Dynamite deliverability is just a click away!

Want to learn more? Catch up with Janel, Jaycee, and Rodrigo by listening to their State of Email Live masterclass.